Owners opting for the scrubber option in order to continue burning the less expensive high sulphur fuel oil (HSFO), as opposed to procuring the more costly compliant 0.5% bunker fuels from 1 January 2020, may see reduced economic benefits as the price spread between the HSFO and low sulphur fuel oil (LSFO) is not wide as they had hoped.

According to information shared by Lloyd’s Register’s global FOBAS manager Douglas Raitt at a recent industry seminar, the price spread between HSFO and LSFO is seen at Mean of Platts Singapore (MOPS) $45 on the forward curve during the first quarter of 2020. Currently, the price spread is at slightly below $90.

These figures have gone down significantly since the early part of this year when available information on the price spread was indicated at more than $200.

Read more: First Singapore 0.5% low sulphur fuel futures contract traded at $200 spread

According to data from Ship & Bunker website, the spread between Singapore high sulphur 380 cst grade and the 0.5% sulphur material has ranged from $100 to $120 in the past week. But Martyn Lasek, editor of Ship & Bunker, stressed that until very recently, there has been zero or near zero demand for 0.5% fuels, no spot demand and hence no meaningful spot indices that can allow owners to make informed decisions.

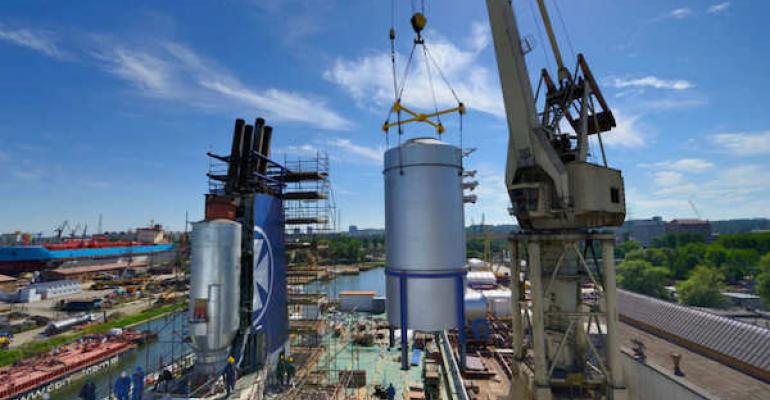

The driving force behind owners’ investment in scrubbers has been the potentially much lower price of HSFO post-2020, making scrubbers economically viable as opposed to needing to purchase the higher priced 0.5% fuels. The bigger the price spread, the higher in cost savings and shorter payback period for those using scrubbers.

A DNV GL study published in October 2018 had suggested that if the spread drops to just $40, there would be no business case for a 20MW scrubber, while a $100 spread would see a payback period of less than two years.

Read more: Business case for scrubbers will ‘disappear in later years’: Drewry

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited. Add Seatrade Maritime News to your Google News feed.