By Wednesday, an early selloff in the capesize papers set the tone for the day, with the index being talked down approximately down $1,500 in the morning session. Bids however, returned aggressively in the afternoon session, pushing Jan back up from its low of $16,800 to $17,200, Q1 from $15,100 to $15,750 and Cal 18 up from $16,650 to $17,250 albeit it in much smaller volume.

“The reason for the bounce remains unclear, but a combination of short covering and perhaps the feeling paper had been oversold with an index that didn't fall as quickly as anticipated, created the short spike.” explained a FIS FFA shipbroker.

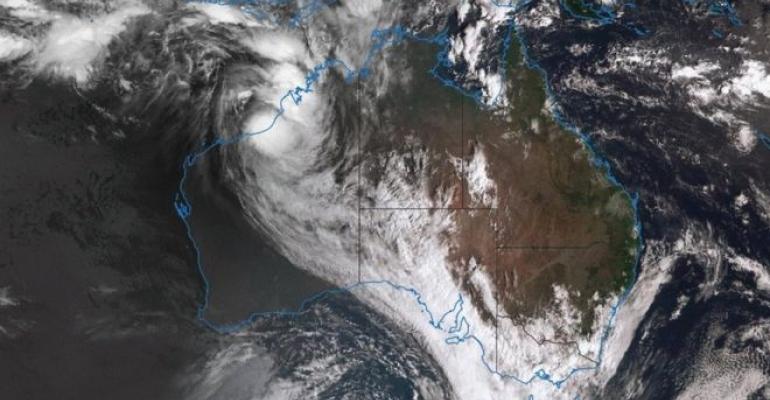

Tropical storm in Australia did not help to support the rates, as Pilbara Ports Authority expects all vessels to clear from Port Hedland by local time 6:30 pm on Thursday, 11 Jan 2018. According to a statement from Pilbara Ports Authority, Cyclone Joyce is expected to intensify as its move toward south-westerly direction, rampaging Port Hedland along its path.

Initially, Joyce was categorised as a category one cyclone on Thursday morning with wind speed estimated around 65km per hour. Later, the meteorologist upgraded the cyclone to category three with wind speed up to 180km per hour.

Currently, the Australia’s Port Hedland is home to miners like BHP, FMG and Gina Rinehart’s Hancock Prospecting. Previously, the terminal shipped around 80m tonnes of iron ore in December 2017, with most of shipments destined for China. Thus, any disruption caused by Cyclone Joyce may have an adverse impact on supply and prompted an upward push for seaborne iron prices amid the pre-Lunar New Year seasonal restocking.

“Changing directional news of the incoming cyclone towards Port Hedland have brought buyers and sellers alike into the market,” observed a FIS FFA shipbroker.

As such, the capesize Q4 18 contract reached a high of $20,250 on Thursday, 12 Jan 2018, up $700 day-on-day, while Q3 18 contract also went up by $325 day-on-day to $17,250.

“However, the day finished with more buyers and some marginal improvements on the nearby months.” he concluded.

Panamax rates began to soften throughout the week with prompt periods the main focus as Feb traded down to $10,600 and March to $11,950 on Thursday. It was at these levels buyers returned with size changing hands between $10,600-$10,750 on Feb throughout the afternoon session and the rest of the curve gained some support, with Q2 trading from $12,350 to $12,550 and Q3 from $11,000 to $11,250.

On the contrary, the supramax paper firmed up as the day session progressed on Thursday. Later on the day, supramax saw some market push with Feb continued to trade in $9,900-$10,000 range, however Q2 was trading $10,600-1$0,825 and the Cal 18 $10,500-$10,625. Meanwhile, the handysize remained very flat with little interest down the curve and the handysize Time Charter Average hit $8,562 on Thursday, down 26 day-on-day.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited. Add Seatrade Maritime News to your Google News feed.