That is according to Clarksons Research md Steve Gordon, who points out that the 2020 sulphur cap (agreed September 2016), Ballast Water Management Convention (October 2016) and carbon reduction targets (April 2018) have all occurred since the last shipbuilding and ship machinery show took place in Hamburg two years ago.

Nevertheless, the current newbuilding orderbook is worth only $221bn, compared to $278bn two years ago, and despite a modest uptick in ordering since a 30-year low in 2016, shipyard output is expected to decline by 10% a year in 2018 and 2019.

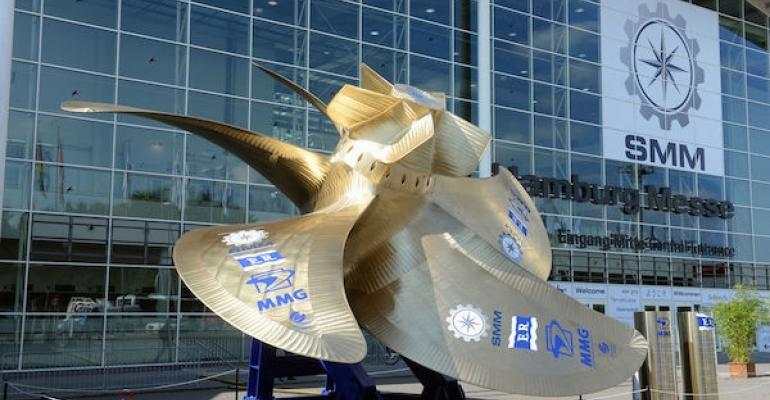

Seatrade Maritime News is reporting live from SMM 2018

Today’s orderbook is dominated by cruise vessels (worth $53bn), followed by tankers ($32.4 bn), bulkers ($23.5bn), LNG carriers ($22.7bn) and containerships ($20.3bn). European yards hold 98% of cruise orders in cgt terms, while overall Chinese yards hold the largest market share with 37% in cgt terms, followed by South Korea (24%) and Japan (18%).

Meanwhile, environmental regulations have led to increased demand for scrubbers and much discussion around future fuel choices. Over 25% of the orderbook by capacity now has a scrubber ordered, with further increases expected, said Gordon, while 2.6% of the existing fleet by capacity has a scrubber fitted or ordered.

Also, 11% of the orderbook by capacity is now LNG fuel capable, he informed, as is 2.5% of the existing fleet.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited. Add Seatrade Maritime News to your Google News feed.