At its recent results briefing, Pacific Basin Shipping, one of the biggest operators of smaller-size bulk carriers, firmly took a position against the use of scrubbers, and even went as far as to state that it preferred a mandate to use low sulphur fuel instead.

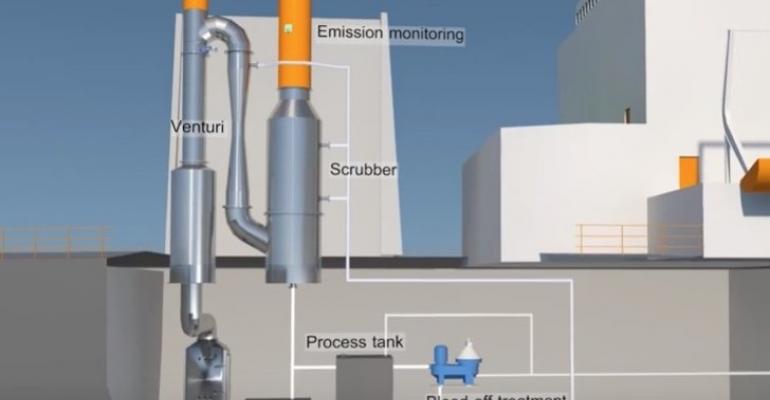

“We do not think that sulphur scrubbers are an effective solution either technically or environmentally,” said ceo Mats Berglung unequivocally.

Highlighting the issue of greater uncertainty affecting the industry because of the sulphur cap regulations, Berglund pointed out that there are also too many uncertainties over the price and availability of fuels, waste water management, potential transition periods before you can practically comply, among many others, making the required investment decision for a scrubber very difficult.

“We much prefer a mandate to use low sulphur fuel and the level playing field, lower speeds and lower emissions (including CO2) this would support,” he reiterated.

Berglund anticipated that the majority of the minor bulks fleet would not invest in scrubbers and use low sulphur fuel instead. The increased demand and use of the more expensive low sulphur fuel will likely result in more slow-steaming and a better supply-demand balance, he suggested.

Adding to a better situation on the supply side, Berglund also said that the increased capex if scrubbers are installed and uncertainty of ship design should hold back newbuild ordering and potentially increase scrapping.

Uncertainties about the future price, types and availability of fuel, potential additional new emissions regulations on nitrous oxide and carbon dioxide for example, as well as faster and potentially more significant technological developments in the longer term would also raise the risk and payback time for newbuildings and possibly put a cap on new orders, Berglund said.

“Whichever way the industry goes on this, we think the effect will be positive as the cost of complying with the new regulations will penalise poor performing and older ships while benefitting stronger companies with high quality fleets, like ours, that are better positioned to adapt and cope both practically and financially with compliance,” Berglund concluded.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited. Add Seatrade Maritime News to your Google News feed.