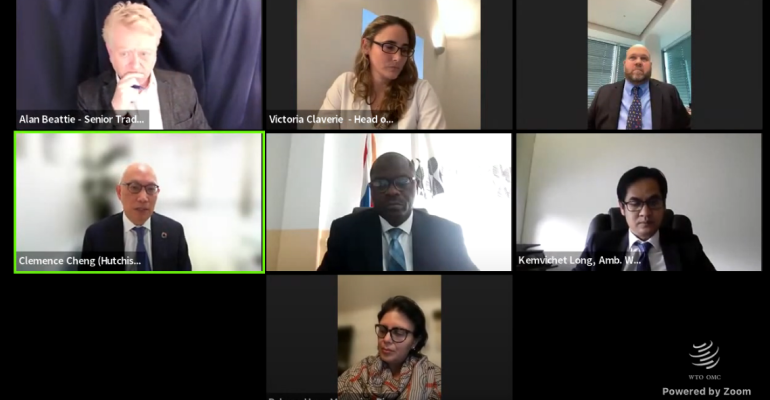

Speaking on a panel titled Supply Chain Disruptions, Impacts and Responses organised by the World Trade Organization on March 21, experts from across the supply chain shared their views on the state of supply chains and possible solutions to widespread disruption.

Bud Darr EVP, Maritime Policy and Government Affairs, MSC Group said that ocean carriers and others in the supply chain were not prepared to cope with severe demand changes over the past two years caused by the pandemic, and there was “a ways to go” before markets normalised.

“In order to have sufficient surge capacity to really be resilient enough to deal with such a massive swing in volumes as we saw here, you need a level of excess capacity that honestly our industry's not able to provide,” said Darr. After decades of razor-thin margins, carriers had become extremely efficient to the point it could not carry excess capacities.

Darr said that unless shoreside supply chains from quay to retail outlet increased throughput, adding capacity to shipping lines would simply enable larger queues of vessels outside ports.

Clemence Cheng, Managing Director, Europe, Hutchison Ports said that containerisation had worked well for decades, but as lines increase their efficiency by creating larger and larger vessels, port infrastructure struggled to keep pace.

“These big ships can be ordered and delivered in a couple of years, but the land side supply chain and the infrastructure to support it, including ports, takes years to develop, particularly in Western countries where environmental issues are of primary concern,” said Cheng.

As vessels grew, port calls became fewer and the strains on port and hinterland infrastructure grew apace. When the pandemic hit, supply chains faced a “perfect storm”, said Cheng, with various impacts on different geographies at different times.

Cheng believed that technology, automation and appropriate infrastructure investments are key to reducing supply chain disruption.

“We have actually observed that some of our terminals which deploy much more automation as well as AI technologies have actually coped much better,” said Cheng.

Victoria Claverie, Head of Trade - Europe, Standard Chartered said that digitalisation was a trend she had noticed with the bank’s clients.

“Supply chain disruptions have certainly encouraged an acceleration in digital transformation across the board, not only when it comes to achieving internal efficiencies and realisation of specific functions, reduction of paper by way of invoicing, [using] AI to simulate specific disruption scenarios, or an adoption of procure to pay platforms to enhance the end-to-end supply collaboration, but also when it comes to connecting with their financing partners,” said Claverie.

Despite the acceleration, “we're still a long way away from digitising trade flows end to end. Many digital solutions, they've only digitized a little piece of the puzzle and we're not able to put it all together as yet, and there are no one size fits all solutions,” said Claverie.

Speakers agreed that decarbonisation was a driver for change in their own businesses and their customers’ business, but Darr warned that decarbonisation may pose fresh challenges for ocean shipping.

“The regulatory landscape is shifting quite rapidly, and one of the things that may happen is there may be a need in general for ships—not just in the liner sector—to slow down worldwide. As that happens, that may also have some impact on the resiliency of the market to equalise back to what is otherwise natural supply and demand state, because of that regulatory influence that is distorting what would otherwise be a market dynamic; not that that's a bad thing, it probably needs to happen, but we need to be prepared for that and accept that's going to have costs both in the shorter term and the longer term as we take this next step towards decarbonisation, which is absolutely essential in my opinion,” said Darr.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |