The UN trade body’s Global Trade Update for December 2022 noted that after a record year, global trade growth had turned negative in the second half of 2022.

UNCTAD pegged global trade at $32trn for 2022, comprising $25trn in goods and $7trn in services. Those estimates represent a 10% increase in trade of goods over 2021, and a 15% increase in services.

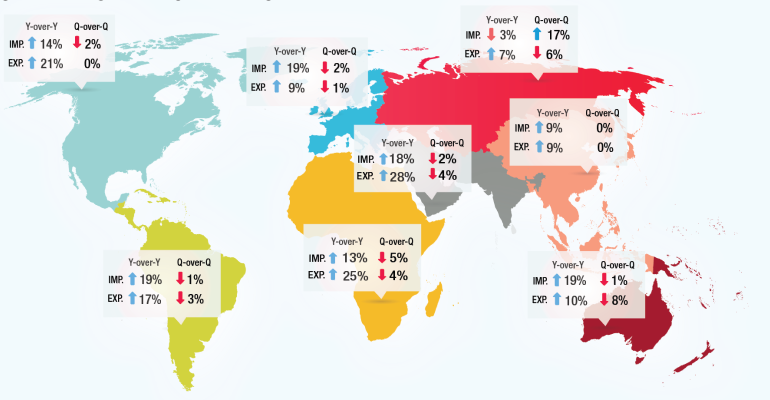

“Those record levels are largely due to robust growth in the first half of 2022. Conversely, trade growth has been subdued during the second half of the year,” said UNCTAD. It’s figures show a 1% drop in the trade of services in Q3 2022 compared to Q2 2022, with a 1.3% increase in trade of services.

UNCTAD’s nowcast assessment of current trade “indicates that the value of global trade will decrease in Q4 2022 both for goods and for services.”

While its preliminary figures show a drop in value for the trade of goods, volumes rose by 3% which UNCTAD said reflects resilience in global demand. Other positive factors noted in the report included an improvement in logistics, lower congestion and falling freight rates.

Trade patterns were being influenced by a reshaping of global supply chains through sourcing diversification, reshoring and near-shoring, all of which are expected to impact trade in the coming year. Trade patterns will also reflect movement towards a greener economy, with carbon intensive goods and fossil fuel energy falling out of favour.

Listen to a podcast on the macroeconomic outlook for shipping in 2023

On the negative side, UNCTAD listed factors including lower economic growth and the high price of goods. High energy prices are bringing down economic forecasts as interest rates rise, while related increases in the price of goods and inputs soften import demand.

The combination of rising interest rates and record levels of global debt bring growing concerns over debt sustainability, said UNCTAD, especially for highly indebted governments in an environment of tightening financial conditions.

“The ongoing trade slowdown is expected to worsen for 2023. While the outlook for global trade remains uncertain, negative factors appear to outweigh positive trends,” said UNCTAD.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |