The country’s Shipping Deputy Ministry announced the new range of green incentives to reward vessels that demonstrate effective emissions reductions and encourage shipowners to hoist the green, yellow and white flag.

From the fiscal year 2021, annual tonnage tax will be reduced by up to 30% for each vessel that demonstrates proactive measures to reduce its environmental impact, ensuring shipowners are rewarded for sustainable shipping efforts.

The Cyprus Ministry is a strong advocate for sustainable shipping and believes broad and diverse measures are needed at both a global and regional level to achieve emissions reduction targets and a sustainable future for the industry.

The EU member country revealed plans some time ago to offer such incentives and got the okay at the end of 2019, when European competition authorities extended the island nation’s tonnage tax regime for 10 years.

The flag has been in steady decline since a mid-1990s peak when around 6% of the world oceangoing fleet flew the flag. Today with just over 1,000 oceangoing vessels of a total gross tonnage exceeding 24m flying the island’s flag it’s world share is just under 2% and the tonnage tax incentive is part of a long-term strategic vision for shipping, maritime and marine-related activities.

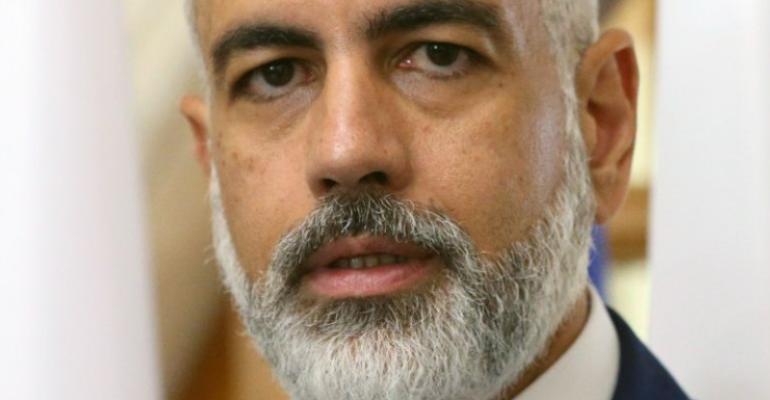

Shipping Minister, Vassilios Demetriades said: “As a leading maritime nation, we have an obligation to support efforts in reducing GHG emissions.”

Cyprus has been promoting the use of cleaner fuels, the deployment of the relevant fuel infrastructure, the electrification of ships, and the use of energy efficiency technologies but believes shipowners need to be rewarded for investment in sustainable practices to accelerate uptake.

“We believe flag states are well-positioned to support ship owners in making sustainable shipping choices which they can benefit from both operationally and financially. Striking the right balance between the green transformation and competitiveness is a challenge but also presents opportunities,” said Demetriades.

Now the Cyprus flag will provide a ‘discount’ on its Tonnage Tax System with what it actually achieves. For example, vessels that have achieved further reduction of their attained EEDI compared to the required EEDI will obtain the respective annual tonnage tax rebate of between 5% and 25%.

The environmental incentive relating to the Imo Data Collection System (DCS) applies to ships above 5,000gt that comply with Regulation 22A of Marpol Annex VI. Ships which demonstrate reduction of the total fuel oil consumption in relation to the distance travelled, compared to the immediately previous reporting period will obtain an annual tonnage tax rebate of between 10 – 20%.

Vessels using an alternative fuel and achieving CO2 emissions reductions of at least 20% in comparison with traditional fuels will receive a rebate on annual tonnage tax of between 15 - 30%. This will be reviewed on a case by case basis, following review of documents submitted from a class society.

Any vessel detained for any reason during PSC inspection, that violates any regulation of European Commission related to the environmental protection, or in laid-up condition (warm or cold) during the calendar year will not be eligible for the incentive.

“Cyprus believes incentives such as this will encourage greater environmental sustainability across the global industry while also enhancing Maritime Europe’s competitive advantage in new green technologies,” said the Minister.

He continued: “This creates opportunities for jobs and growth, providing a first-mover advantage to the EU shipping industry. Clear objectives for 2030 and 2050 have been set by the Imo and all industry stakeholders must unite to create a clear pathway to achieve and exceed these goals.”

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |