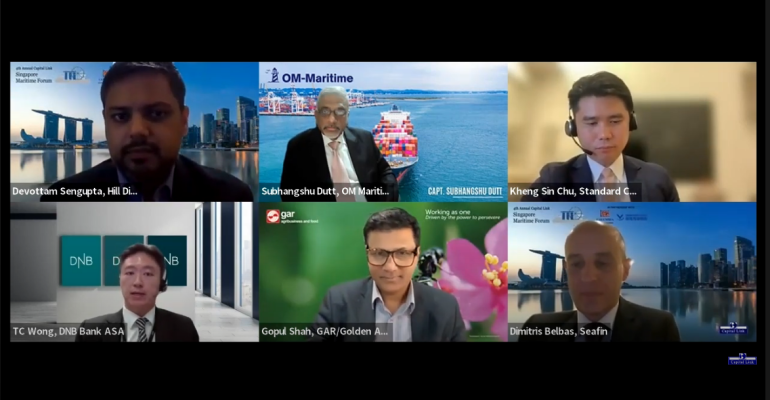

Speaking at the Capital Link Singapore Maritime Forum as part of Singapore Maritime Week, experts in ship finance shared the factors they worry might bring an end to a strong period in shipping finance.

Kheng Sin Chu, Managing Director and Regional Head, Shipping Finance, Standard Chartered, said that on top of geopolitical uncertainty and environmental pressures, we are in an inflationary market.

“Asset prices, especially in certain sectors, are an all-time high. So, we are already at an inflationary bias and… governments are looking to counter that by both fiscal and monetary policy. The kind of policy available is raising interest rates. So, there could be a period where we are looking at an inflationary period plus heightened interest costs.”

Kheng Sin said he reminded junior banker who have grown up over the last 15 years at 0.5%-1.0% LIBOR that rates hit 8% in 1990, and while he doesn’t expect a repeat of the same extremes, “we could be in a tricky spot a couple years down the road where you have the dual storm of high asset inflation plus high interest rates.”

Cash balance discipline and business agility are the means to weather such a storm, the panel agreed.

Dimitris Belbas, Head of Shipping Finance, Asia Pacific, Seafin, said he would be very concerned to see greenfield shipyards reactivated again as shipyard capacity remains constrained. Greenfield shipyards were one of the factors that brought down the market 14 years ago, said Belbas, and it took the Chinese a long time to consolidate and streamline their operations back down.

“It's a good thing right now that if you want newbuilding orders, they are capped to the extent that you cannot go and order a vessel and get it in one or two years. It's good for the ships in the water,” said Belbas.

Another factor currently absent from this strong shipping market is over-leveraging, said TC Wong, CFA, Corporate Banking, APAC, DNB Bank ASA.

“What could be a bit different this time round is that we do see some equity providers have been stepping up. I think that there is increased recognition that, shipping is a highly volatile industry, but it's not really meant to be a highly levered one. So, we do see more discipline in in this aspect, and also on the lender side. Lenders are less keen to provide high leverage, especially when markets are high,” said Wong.

Gopul Shah, Head of Treasury, GAR/Golden Agri said that the past two years had been very good the industry, added liquidity in the market had fuelled volatility.

“Going forward, although the returns and profits look very good and attractive, I think risk will remain heightened as far as the real economy is concerned, because there are many things which are coming up in the market.

“There are many risks and keeping tabs on risk and managing your business will become a very big priority, going back to basics,” said Shah.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |