Traditional financial systems have struggled to meet their needs. As it stands, payments can take weeks to arrive, and employers and employees often encounter a multitude of additional fees and costs when transferring money. And while life at sea has much to recommend it - good pay, job satisfaction, the ability to travel the world – this payments complexity has been a major disincentive in an industry where labour is already tight.

Seafaring will often involve long periods away from home. Seafarers need to find ways to get money back home to pay rent and energy bills, and support their families while they’re travelling. They have no access to conventional banking options during their long stretches at sea, and when other transfer methods prove too slow, or seafarers want to spend on the go, employers are often forced to use cash for salaries.

Up to 20% of salaries in shipping today, equal to more than $10bn annually, are paid in cash. This is an insecure and expensive way to do business, with employers paying as much as 5% – 12% of the underlying value to get cash on board. Seafarers end up with commissions and bank charges. Exchange rates are poor and unpredictable. They have no certainty of when and how they can change money or the rate of exchange. There is also a security problem. Carrying cash is burdensome and risky, leaving seafarers vulnerable to theft.

It is also desperately inefficient for the companies who pay them. There is the complexity of paying salaries across the globe, dealing in cash, and tax reconciliation, plus hefty fees and administration costs.

An alternative solution for managing salary payments in shipping

Kadmos is a platform that specialises in powering secure payments to seafarers across the globe. For the reasons outlined above – the company recognised that it needed to develop a secure salary payments platform that would make paying crew more efficient and drastically reduce administration and transfer costs.

David Rosa![David Rosa Headshot[36].jpg David Rosa Headshot[36].jpg](/sites/cet.com/files/David%20Rosa%20Headshot%5B36%5D.jpg)

This is where Rapyd came in.

A global fintech company, Rapyd makes international payments possible – and easier – for businesses. It combines various payment methods like bank transfers, local debit cards, digital wallets, and even cash into one user-friendly platform, allowing businesses to efficiently handle payments across different countries, meeting each market's unique needs and requirements, all on a single global platform.

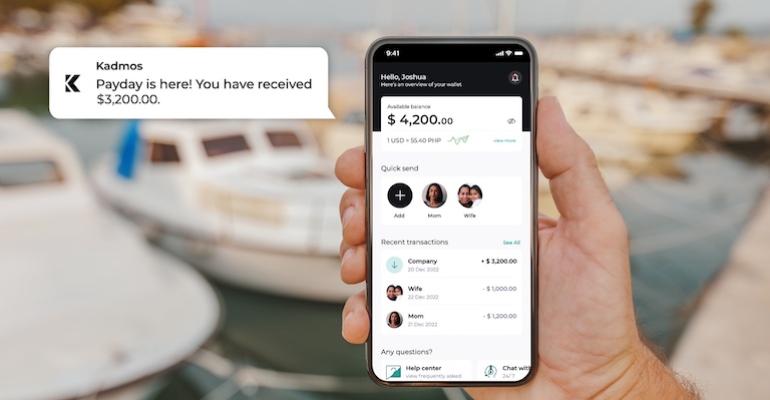

By using Rapyd to underpin its new salary payments platform, Kadmos is able to pay seafarers via a secure, functional and cost-effective mobile app. They receive their money, regardless of whether they’re at sea or in port, through a digital wallet, which can then be used to pay bills, send money home and make online purchases. They can also use a Visa debit card to make purchases at ports and to withdraw cash.

Not only that, but through Kadmos, seafarers can now track payments and spending on the app, keep the salary in their wallet in stable currencies such as US Dollars, Euros or British pounds, and save money on transfers and exchange rates, with no need to shop around for the best price, ensuring that they retain more of their salaries.

Importantly, using Rapyd, Kadmos has the peace of mind that its system is fully secure and transparent. No more trying to find safe places for cash – the whole system is protected by European e-money regulations.

It’s also been a boost for Kadmos’s clients. Global shipping companies can pay their seafarers faster and for less, giving them a competitive advantage in hiring staff at a time when labour shortages are rife. It also saves on administration costs.

Paying seafarers may be a uniquely tough problem to crack, but it is clear that there are other parts of the logistics supply chain which could also benefit from adopting a new approach to payments. All cross-border employees working in industries such as construction, healthcare, and hospitality face similar challenges when it comes to salary payments. There are 180 million migrant workers worldwide travelling and working across the globe.

Fortunately, a new breed of payments technology is emerging to provide a much better service to seafarers and many other industries, with the ability to get paid quicker and more efficiently being a key selling point. For Kadmos, powered by Rapyd, it is a groundbreaking solution that has reshaped the organisation’s approach to cross-border payments

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |