Low water levels in the Panama Canal have seen a shift of some services to the US East Coast from the Panama canal to Suez in order to prevent long delays at either the Pacific or Atlantic end of the canal.

Conflict in the Middle East, however, has seen a host of ships attacked in the Red Sea, near Yemen, by the Houthi movement, which has vowed to continue its attacks as long as Israel maintains its bombardment of Gaza. That has led to a number of carriers diverting vessels around the African Cape.

Industry analyst John McCown writes in his November report on US ports that the last three months has seen a shift of freight to the East Coast from West Coast ports. Growth on the East Coast was seen to be outpacing West Coast imports from 2017 onwards, apart from a brief period in 2021. That trend has seemingly gone into reverse.

“A contributing factor is the Panama Canal where lower water levels has reduced the number of transits and caused delays. November saw a 29% decline in the number of large 10,000 – 14,000 teu container ships going through the canal,” wrote McCown.

That situation has been alleviated slightly with the announcement that transits will increase to 24 a day, from the current 20 per day, following a sustained period of rain, however, the dry season is about to start in Panama.

Xeneta’s Chief Analyst Peter Sand explains the possible effects of a prolonged dry season: “Rates could easily double as a consequence,” said Sand, adding, “There are seven weekly services that transit the Panama Canal, if they were all to be re-routed via Suez that would require an extra three ships on each service to maintain the weekly calls.”

According to Sand July should see the next rainy period in Panama and there is a need for those rains to refill reservoirs if normal service, of up to 36 transits daily, but if the rains fail to lift the water levels sufficiently next year the delays and restrictions could last into 2025.

Sand also pointed out: “There are seven weekly services that transit the Panama Canal, if they were all to be re-routed via Suez that would require an extra three ships on each service to maintain weekly calls.”

Such an increase in deployed tonnage comes with extra costs along with the extended travel times and fuel consumption will lead to extra charges but the challenges being faced in both canals will also see increased emissions, adding to costs.

Athens-based tech company VesselBot analysed the current numbers of vessels waiting to transit the Panama Canal, with the extra emissions from extended waiting times included.

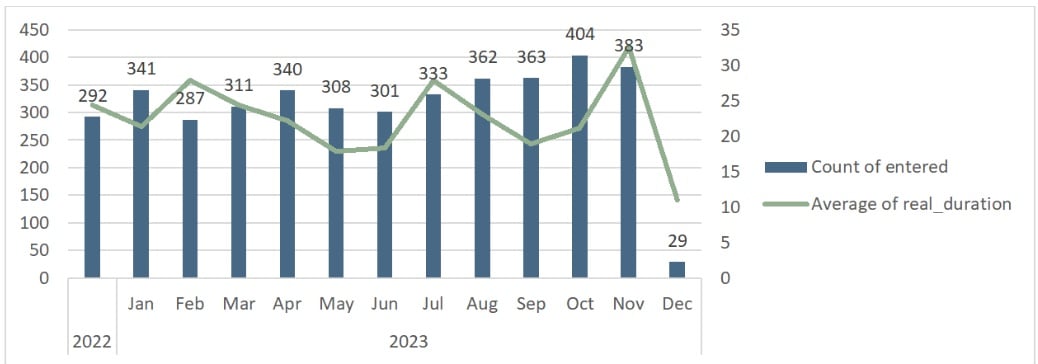

VesselBot CEO and founder Constantine Komodromos said: “The peak for vessels entering the [Panama Canal] anchorage concluded in October, and there was a bottleneck in November. As shown in graph 1 (below), in October, 404 vessels entered both anchorages and resulted in an average of 32.55 hours waiting at anchorage in November, making it the peak anchorage waiting time through the year.”

Transit delays and increased canal costs had already seen fewer ships arriving at the Panama Canal, at both ends of the waterway, as ships diverted from the choke points.

Even so, Komodromos said November had seen a spike in emissions to 12,000 tonnes in greenhouse gas emissions, an increase of more than 5,000 tonnes since January of this year.

Meanwhile, another emissions tracking tech company, SeaRoutes calculated vessel diversions from Suez to around the cape transiting the African Cape, rather than heading via Suez will substantially increase fuel consumption and therefore emissions and costs.

SeaRoutes estimates emissions for a vessel operating from Shanghai to New York via Panama, Suez and the Cape, with the shortest route via Panama and the distance via Suez around 40% longer adding more than half a tonne of CO2 per teu plus more than 30% to the journey time. See table below from SeaRoutes.

![SeaRoutes Table 2[23].jpg SeaRoutes Table 2[23].jpg](/sites/cet.com/files/SeaRoutes%20Table%202%5B23%5D_0.jpg)

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |