The latest Container Shipping Market Quarterly Review, published by the Global Shippers Forum GSF and MDS Transmodal, highlighted how shippers had turned to rail between China and Europe, air freight and chartering their own vessels.

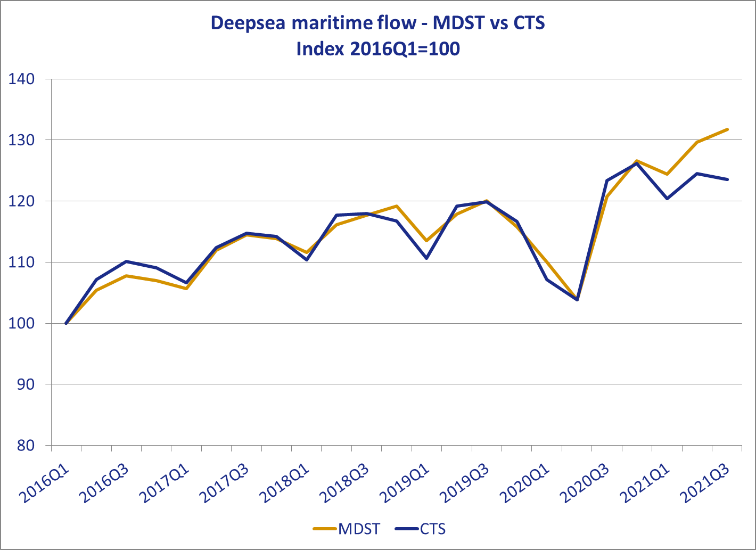

The report used a graph (shown below) to compare imported volumes (gold line) with volumes carried by scheduled ocean liner services (blue line). It showed that import volumes growing rapidly in Q3 while scheduled container line capacity actually declined slightly.

“The Container Shipping Market Review shows the extent to which shippers sought out alternatives, as shipping lines priced themselves out of reach and narrowed the cost difference with offerings from other modes. A measurable share is also accounted for by vessels chartered by shippers for their own goods, or by other non-liner shipping carriers,” James Hookham, GSF Director.

Mike Garratt, Chairman of MDS Transmodal, said: “Given the dramatic growth in freight rates and declining service performance it is not surprising to see trade growing more quickly than container volumes on the established lines, as shippers have found other transport solutions; starting own shipping routes, using long-haul rail or air or semi-bulk traffics switching to conventional methods.”

The report also highlighted how shipping lines have shifted towards shuttle services calling limited ports in two regions rather than multi-region services. As ports have become congested container carriers have increasingly dropped calls at intermediate ports.

“Our review this quarter has examined how alliance members have expanded their role in developing consortia and therefore market shares and the way in which they have addressed operational challenges in modifying route structures. This reduction in services linking multiple world regions has been accompanied by a decline in the number of countries that are directly connected,” Garratt explained.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |