Hong Kong-listed Orient Overseas International (OOIL), parent of OOCL, reported a profit attributable to equity holders of $1.13 billion for the first half of 2023 compared to $5.75 billion in the same period in 2022. Revenues in the first half of the year more than halved to $4.54 billion for the first six months of 2023 compared to $11.06 billion in the same period in 2022 as revenues per teu fell by 60% year-on-year.

“As was clearly to be expected, the extraordinary market conditions of the past two to three years came to an end. The long, steady decline in freight rates, which began around the middle of last year, continued during the first half of 2023,” OOIL commented.

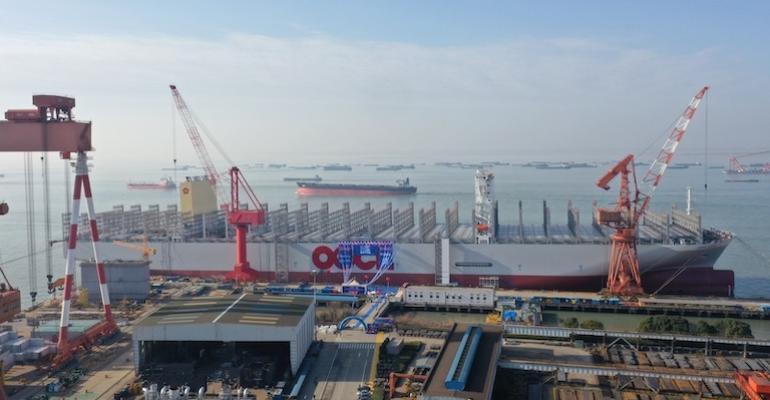

OOCL saw its container liftings drop by 1% in the first half of 2023 while loadable capacity to 4.42 million teu up from 4.22 million teu a year earlier. In the first half of 2023 OOCL took in the first two in a series of 24,188 teu newbuildings.

Looking ahead the company said that while there had been more positive sentiment in recent weeks, especially on the US West Coast, challenges remained ahead with conflicting signals continuing to make market forecasting difficult.

While there are challenges OOIL stated: “Certainly, the market is very far from being in disaster territory, and of course there are some indications that demand is improving and that shipping companies are behaving rationally in the face of fluctuating demand - all of this is reassuring.”

There were however risks associated with the impact of inflation and higher interest rates on consumer spending, and the overall economic outlook. Net fleet growth for container shipping also remains uncertain as while there is a large orderbook being delivered over the next two years the impact scrapping, speed reductions, and environmental regulations such CII and EEXI remains uncertain.

“At the time of writing, our ships are sailing full on our main long-haul tradelanes, and are forecast to continue to be fully loaded in the coming weeks. US West Coast rates have indeed risen, as one might expect at this time of year. Similarly, Asia Europe rates are currently holding and in some tradelanes increasing.”

Despite these positive factors OOIL said a “cautious outlook” remained.

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |