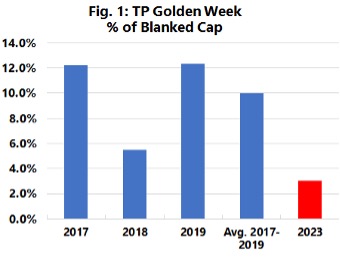

Specifically looking ahead at the four-week period that starts with Golden Week, China’s annual national celebrations where industry shuts down before re-emerging in the ensuing period, blanked sailings appear to be at a five-year low.

On the face of it, this should be more good news for an industry that has seen a bonanza in profits since just after the beginning of the pandemic. In the period 2020 through to the end of 2022, it racked up more than $300 billion in profits, probably only exceeded by the tech industry in that period.

Blanked sailings are usually a result of a combination of factors, weak demand, a surplus of capacity and the resultant collapse in rates, and therefore income, and the increase proportionally in costs for the carriers.

Since the latter part of 2022 all of the above factors have come into play. A tsunami of newbuildings set to increase global fleet capacity by around 30%; inflation driving up interest rates and demand down in a period where inventories are at record levels; freight rates having climbed the proverbial mountain now plumbing the depths of the San Andreas Fault; and fuel costs rising as the result of geopolitical tensions, mainly the war in Ukraine.

Given this stew of half-baked ingredients we should expect blanked sailings to rise like my mother’s bread, instead it has fallen flat like one of my witticisms.

To explain this phenomenon a Drewry Shipping Consultant spokesperson said: “Ocean carriers are now also more actively hiding capacity via slow steaming, rather than just using the blank sailing strategy, which has not been the case before.”

Given the sheer scale of new capacity entering the market, and the fact that the new vessels are generally very large, limiting the areas where they can be deployed, generally on the lucrative Pacific and Asia to Europe trades, and also causing existing capacity to be cascaded to more minor trades, the hit to the lines is expected to be very damaging.

As Sea-Intelligence CEO and founder Alan Murphy has an alternative theory: “The carriers have more capacity than they know what to do with, and active capacity management is a difficult game to play.”

He said as the major lines now all belong to alliances, the asset provider in the alliance “that removes capacity pays the entire cost of doing so, while everyone else reaps the same benefits.”

Given that the carriers are now flush with billions of dollars in pandemic cash, accrued on the back of struggling shippers who are “rightly furious about the past three years,” Murphy believes the shipping lines have switched their focus to gaining market share, rather than focusing on profitability.

“The challenge of course being that there is no longer loyalty in volumes, as carrier-shipper relationships are frayed thin to the point of breaking,” said Murphy.

Moreover, carriers proved that during the pandemic volume crash of first-half 2020, where carriers blanked up to 50% of capacity in some weeks, to match the crash in volumes, blank sailings were used as a “short-term and relatively costly way of removing capacity”.

This is not an option in today’s market argues Murphy: “In order to balance supply with demand, carriers would have to long-term blank so much capacity that we would no longer be a liner industry but would return to the 18th century tramp industry.”

Unreliable service schedules were understandable in the farrago of a congestion meltdown, port infrastructure stresses and inland connection dislocation during the pandemic, but it is “difficult to justify when the only reason is low rates”.

On the face of it, Murphy explains: “A more reasonable approach to balancing supply with demand would entail a large-scale programme of service closures, cold lay-ups of a significant part of the fleet (as in 2009), and scrapping of older, fuel-inefficient vessels.”

In both 2020 and 2009 large-scale capacity removal programmes were triggered by the “hard reality that carriers had no other option”, as they were desperate for cash.

“This time round the wolf is not at the door, so carriers are not taking the necessary measures, as ‘the right choice’ could be interpreted as weakness. Thus, I've been quoted many times, for saying that the only thing that scares me more than carriers without money, is carriers with money,” said Murphy.

He added: “Of course, the easier solution would be for carriers simply not to charge loss-making rates as soon as the vessels aren't full, but I've been shouting that at deaf ears for 20 plus years, so I guess that's not an option.”

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |