The US Coast Guard, along with the US Department of State, and the US Treasury- historically the fulcrum of US sanctions enforcement, are joint authors of the new Guidance to Address Illicit Shipping and Sanctions Evasion Practices, issued in mid-May.

In the publication, it states that: “At a later date, OFAC may issue further updates to this advisory, including with respect to the vessel lists that have appeared in previous shipping advisories.” The Office of Foreign Asset Control, an arm of the U.S. Treasury has included ships (mainly tied to North Korea and to Iran) in its “SDN”- the Specially Designated Nationals and Blocked Persons List.

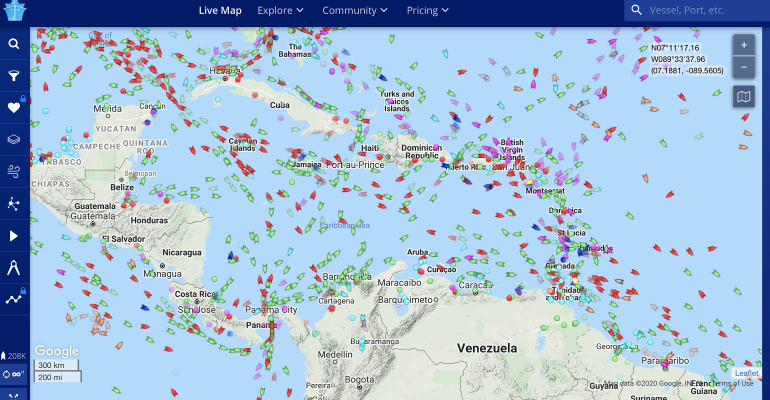

The new guidance comes at a time that all eyes are on a quartet to Iranian tankers that appear to be bound for Venezuela with cargoes of refined products- reported variously to include gasoline. Both Iran and Venezuela fall under US sanctions. With the recent bellicose rhetoric surrounding tankers and US naval assets in the Arabian Gulf, observers have raised alarm bells about possible US actions if these vessels defy sanctions. AIS has figured prominently in various accounts, as analysts have pointed to AIS entries for the vessels, tied to loadports in Iran, changed from Venezuelan destinations to non-specific “For Orders”, or similar.

The advice proffered by the US government has the potential to get deep down into the specifics of shipping practice- beyond high level generalities. The guidelines encourage industry participants to: “As industry actors implement appropriate due diligence and compliance programs based on their risk assessments, we recommend that they continually adopt business practices to address red flags and other anomalies that may indicate illicit or sanctionable behavior.”

The red flags include disabling AIS, falsifying vessel and cargo documents, as well as ship to ship transfers, “voyage irregularities” and complex ownership or management. But the wording drills down deeply into day-to-day activities of shipping companies, and service providers. Annex A of the guidance provides very specific guidance for maritime insurance companies, flag registry managers, port state control authorities, shipping industry associations, regional and global commodity trading, supplier, and brokering companies, financial institutions, ship owners, operators, and charterers , classification societies, vessel captains, and crewing companies.

There are many examples of potential implications for maritime contracts, for example it is suggested that participants in chartering deals: “[Adapt] contractual language with clients, in the form of an AIS switch-off’ clause, allowing ship owners, charterers and operators to terminate work with any clients that demonstrate a pattern of multiple instances of AIS manipulation that is inconsistent with SOLAS.”

Law firm Seward & Kissel, with an active practice serving entities involved in international shipping and finance, noted: “In short, OFAC and the US Department of State have recently focused on the shipping industry and we expect that trend to continue in the near term.”

The new guidance can be found at:

www.treasury.gov/resource-center/sanctions/Programs/Documents/05142020_global_advisory_v1.pdf

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |