Speaking on a Marine Money webinar Frew, director of consultancy for MSI, noted that carriers have seen a decline in the freight rates per container during 2020.

Expectations are for a market trough, but “nowhere near as low as that of 2016”, in Q3 2020, with the mainline trades most affected, followed by a recovery, albeit with some risks tied to significant idle capacity, in 2021.

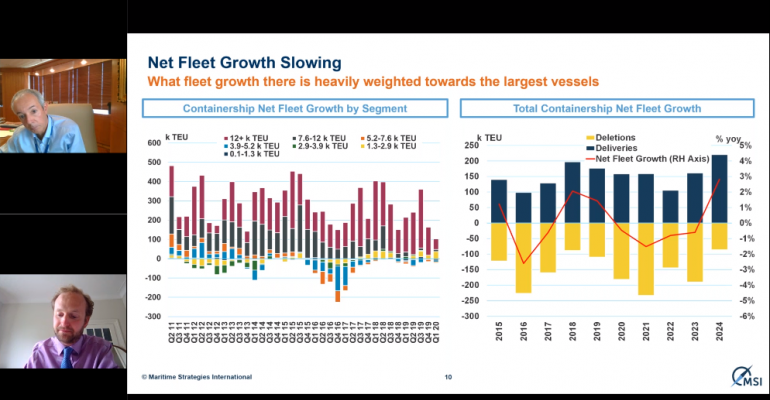

Using a series of charts, he illustrated that net fleet growth has slowed, with most growth coming in the largest sized vessels, with “net negative fleet growth expected over the next three years…that’s almost unprecedented for containerships.”

Frew, stressed the importance of the “cascading” on containership market dynamics. He explained that MSI’s modeling devotes great attention to these dynamics and is a key driver of the performance of different container shipping assets. He told listeners, “…if the cascade is inefficient…then you could potentially benefit from some very positive supply/demand balances for smaller vessels.”

He went on to identify the intra-Asia trade, providing one-third of all container trades, at a time that a post Covid-19 rebound is seemingly underway, as a key determinant of the cascade’s impacts. “That’s one of the key things we will be watching” he said, “…in determining the investability of different container asset classes.”

Copyright © 2024. All rights reserved. Seatrade, a trading name of Informa Markets (UK) Limited.

Add Seatrade Maritime News to your Google News feed.  |